Download to Stop Ramadan 2026 Zakat Deductions on Bank Accounts CZ 50 Form

If you have a saving account or profit account in Pakistan, you may see a Zakat deduction in your bank statement at the start of Ramadan.

This deduction is done automatically by banks.

Zakat is an important religious duty. However, many people prefer to give Zakat by themselves to family members, poor people, mosques, or charity organizations.

If you want to pay your Zakat on your own, you must take action before Ramadan starts.

1. Why do banks deduct Zakat?

Under the Zakat and Ushr Ordinance, banks in Pakistan are required by law to deduct 2.5% Zakat from certain bank accounts.

Zakat is deducted only if your account balance reaches the Nisab amount.

The government announces the Nisab every year before Ramadan. It is based on the price of silver.

2. Which accounts are affected?

- Saving Accounts

Zakat is deducted from these accounts. - Profit and Loss Sharing (PLS) Accounts

Zakat is also deducted from these accounts. - Current Accounts

Zakat is usually not deducted from current accounts. - Non-Muslim Account Holders

Zakat is not deducted, but a declaration must be submitted to the bank.

3. How to stop automatic Zakat deduction

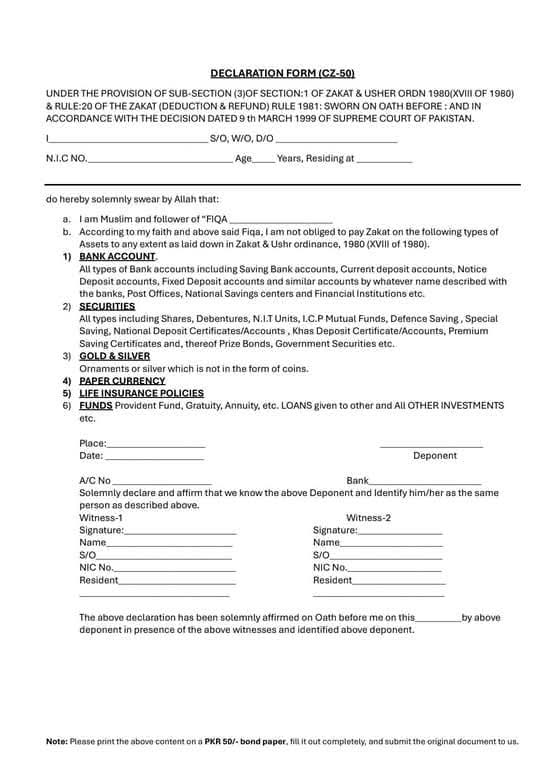

If you do not want the bank to deduct Zakat automatically, you must submit a Zakat Exemption Affidavit.

This form is called the CZ-50 form.

By submitting this form, you inform the bank that:

“I will calculate and pay my Zakat myself.”

4. How to submit the CZ-50 form

The process is simple, but you must do it on time.

Step 1: Get the form

You can get the CZ-50 form from:

- Your bank branch, or

- The official website of your bank

Step 2: Use stamp paper

The form must be printed on legal stamp paper.

Usually, stamp paper value is Rs. 50 or Rs. 100, depending on your province.

Step 3: Attestation

Sign the form in front of a:

- Notary Public, or

- Oath Commissioner

This makes the form legally valid.

Step 4: Submit to the bank

Submit the original form to your bank branch.

Important tip:

Always keep a photocopy and ask the bank to put a “Received” stamp on it for your record.

5. Important deadline

This is very important.

Banks stop accepting CZ-50 forms a few days before Ramadan.

If you submit the form on the first day of Ramadan, it will be too late.

It is best to submit the form at least two weeks before Ramadan.

Summary Table

| Feature | Details |

|---|---|

| Zakat Rate | 2.5% of total balance |

| Deduction Date | 1st day of Ramadan |

| Exemption Form | CZ-50 Affidavit |

| Best Time to Submit | Before Ramadan starts |

Final Words

Paying Zakat is a personal religious responsibility.

You can allow the bank to deduct it, or you can distribute it yourself.

If you want full control over your Zakat, make sure your CZ-50 form is submitted on time, so your money is handled exactly the way you want.