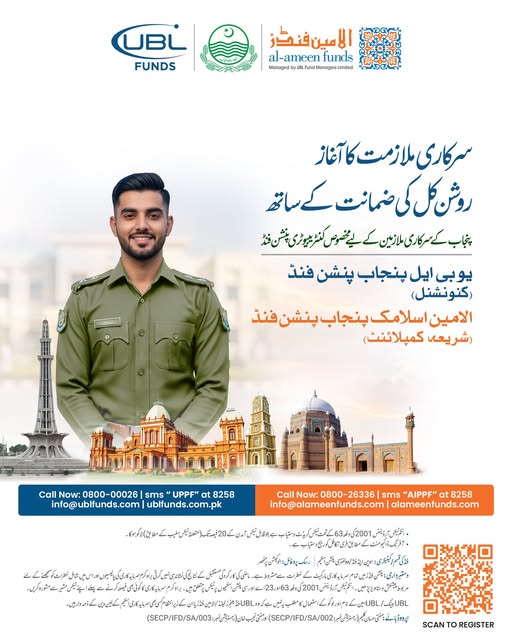

UBL and Punjab Government Launches Contributory Pension Scheme 2026 for Secure Retirement

The Government of Punjab has officially launched a Contributory Pension Scheme to provide long-term financial security to government employees after retirement. This initiative is being described as a major step towards ensuring a stable and worry-free future for public servants who dedicate their lives to serving the province.

The scheme is being promoted under the message “Sarkari Mulazamat ka Aghaz – Roshan Kal ki Zamanat kay Sath”, which means starting government service with a guarantee of a bright future. The program focuses on helping employees build savings during their service period so they can live comfortably after retirement.

Why the Contributory Pension Scheme Was Introduced

In the past, many retired government employees faced financial difficulties due to limited pension benefits and rising living costs. Keeping this issue in mind, the Punjab government introduced this new system to strengthen retirement planning through regular savings and professional investment management.

Under this scheme, employees contribute a portion of their income into a pension fund during their service. The collected funds are invested in regulated financial instruments, allowing savings to grow over time. After retirement, employees receive pension benefits based on their accumulated contributions and investment returns.

Pension Fund Options for Employees

The Punjab government has provided employees with two pension fund options, allowing them to choose according to their financial preferences and beliefs.

The first option is the UBL Punjab Pension Fund, which follows a conventional investment model. This fund is managed by UBL Fund Managers Limited, a well-known and SECP-regulated asset management company in Pakistan. It is suitable for employees who prefer traditional financial investment methods.

The second option is the Al-Ameen Islamic Punjab Pension Fund, which is fully Shariah-compliant. This fund is designed for employees who want their savings to be invested according to Islamic principles. It ensures that all investments follow Islamic finance rules, making it a trusted choice for those seeking halal investment options.

Government Backing and Transparency

One of the key strengths of this pension scheme is that it is backed by the Government of Punjab and regulated by the Securities and Exchange Commission of Pakistan (SECP). This ensures transparency, accountability, and proper management of funds.

Both UBL Fund Managers and Al-Ameen Funds operate under strict regulatory frameworks. Regular audits, reporting requirements, and compliance checks are in place to protect the interests of contributors.

Benefits of Joining the Scheme

The Contributory Pension Scheme offers several benefits to Punjab government employees. First, it encourages disciplined savings, helping employees set aside money regularly without financial stress. Second, professional fund management helps generate better long-term returns compared to keeping savings idle.

The scheme also reduces financial dependency after retirement. Instead of relying solely on family support or limited pension payments, retirees can enjoy a steady income stream, allowing them to maintain a dignified lifestyle.

Another important benefit is choice and flexibility. Employees can select either the conventional or Islamic pension fund based on their personal preferences. This inclusivity has been widely appreciated by government employees across the province.

How to Join the Pension Scheme

The Punjab government has made the registration process simple and accessible. Eligible employees can join the scheme through the official portal:

👉 https://pension.punjab.gov.pk/

The website provides complete guidance, eligibility details, and step-by-step instructions for enrollment. Employees can also find information about contribution methods and fund selection.

For further details, employees interested in the UBL Punjab Pension Fund can visit:

👉 https://www.ublfunds.com.pk/products/punjab-pension/

Helpline and Support Services

To assist employees, dedicated helplines have been established by the fund managers. UBL Funds can be contacted at 0800-00026, while Al-Ameen Funds offer support through 0800-26336. These helplines provide information about fund performance, enrollment procedures, and general queries.

A Step Towards Financial Stability

Financial experts believe that the launch of the Contributory Pension Scheme is a positive reform in Punjab’s public sector. With rising inflation and increasing life expectancy, long-term retirement planning has become essential.

By encouraging early savings and professional fund management, the Punjab government aims to reduce post-retirement financial stress and promote economic stability among retired employees. The initiative also aligns with international best practices, where contributory pension systems play a key role in social security.

Conclusion

The Punjab Government’s Contributory Pension Scheme marks a significant milestone in public sector welfare. By offering both conventional and Islamic pension fund options, the program ensures inclusivity, transparency, and financial security.

Government employees are strongly encouraged to join the scheme early in their careers to maximize benefits and secure a peaceful future. With official backing, professional management, and easy enrollment, the scheme promises to be a reliable solution for retirement planning in Punjab.